Why IT ROCKS

-

Get paid to local receiving accounts

Receive bank account numbers in EUR, USD, GBP & more and get paid as easily as having a local bank account.

-

Expand into new marketplaces

Connect with thousands of marketplaces and start getting paid within a couple of clicks.

-

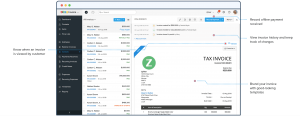

Request a payment

Offer your international clients a simple way to pay you with our Billing Service.

-

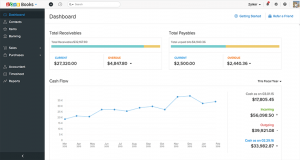

Access working capital

Invest in the future by managing your cash flow.

-

Withdraw your earnings

Transfer your earnings to your local bank account at low rates or via ATM.

-

Pay your VAT

Pay the VAT authorities in the EU and UK with the GBP and EUR funds in your Payoneer account, for zero fees.

-

Pay your suppliers

Reduce costs and simplify processes by paying your contractors from your Payoneer balance for free.

-

Connect with partner ecosystem

Leverage our network of integrated service providers to simplify your business, help you grow globally and enjoy benefits.

Pricing

GET PAID

-

By another Payoneer customer

When you receive payments from other Payoneer customers who pay from their Payoneer balance, it’s always free!

-

FREE

EUR, USD, GBP, and more

-

Directly by your clients

Send payment requests to your clients and give them the option to pay you via credit card and ACH bank debit (US only). They can also use your receiving account details to pay you via local bank transfer.

-

3%

Credit card (all currencies)

-

1%

ACH bank debit

-

Directly by marketplaces and networks

We’re integrated with Wish, Fiverr, Upwork, Airbnb, and thousands of other companies who pay with Payoneer. Treat yourself to a seamless payment experience.

-

Note: Bank processing fees, landing fees, or other intermediary fees may be deducted from the withdrawn amount by your bank or any other payment provider not directly associated with Payoneer.

-

Fees set by each marketplace or network may vary. Please check their website for precise rates.

-

Via receiving accounts

Use your receiving accounts just like a local bank account in the associated country to get paid in USD, EUR, GBP, and more.

-

Free*

EUR, GBP, and more

-

*Fees may apply for payments below a minimum amount

WITHDRAW FUNDS TO YOUR BANK ACCOUNT

Once you get paid, you can withdraw those funds to your local bank account with a few clicks. Fees vary depending on the currency of your account, but the convenience and simplicity is always the same.

-

Withdrawals in local currency from a Payoneer balance of a different currency

Example: USD balance –> EUR bank account, bank is in EU

-

You can withdraw funds to bank accounts in most currencies, and enjoy competitive rates from Payoneer.

-

Note: Bank processing fees, landing fees, or other intermediary fees may be deducted from the withdrawn amount by your bank or any other payment provider not directly associated with Payoneer.

-

UP TO 2% OF TRANSACTION AMOUNT

The exchange rate of the transaction is based on wholesale currency market rates obtained at the time of transaction from a range of financial institutions and includes the conversion fee where indicated.

-

Withdrawals in local currency from a Payoneer balance of the same currency

Example: USD balance –> USD bank account, bank is in US

-

When withdrawing USD, EUR, or GBP to a local bank account, there is a fixed fee on the transaction for your convenience, if the bank account:

-

• is in the same currency as your balance

-

• is in a country where the withdrawal currency is the local currency

-

• is in the same country that you have listed in your Payoneer profile

-

1.50 USD

USD to USD withdrawal

-

1.50 EUR

EUR to EUR withdrawal

-

1.50 GBP

GBP to GBP withdrawal

-

Withdrawals in local currency from a Payoneer balance of the same currency

Withdrawals in non-local currency

-

Example: USD balance –> USD bank account, bank is in EU EUR balance –> USD bank account, bank is in Hong Kong

-

You can withdraw funds to bank accounts in most currencies, and enjoy competitive rates from Payoneer.

-

Note: Bank processing fees, landing fees, or other intermediary fees may be deducted from the withdrawn amount by your bank or any other payment provider not directly associated with Payoneer.

-

UP TO 2% OF TRANSACTION AMOUNT

For withdrawals with no currency conversion, minimum fee may apply

-

The exchange rate of transactions with conversion is based on wholesale currency market rates obtained at the time of transaction from a range of financial institutions and includes the conversion fee where indicated.

-

The Payoneer Commercial Mastercard®

-

The Payoneer Commercial Mastercard® enables you to easily use your Payoneer funds to make business purchases, pay for advertising, buy goods and business services online or in stores, and withdraw funds at ATMs, across the globe.

-

Payoneer account creation

-

Free

-

Card delivery (standard delivery)

-

Free

-

Annual card fee:

-

• First card

-

29.95 USD

-

• Additional cards in any currency

-

Free

-

Transactions in the same currency as your card, in supported countries*

-

Free

-

Transactions involving currency conversion

-

Up to 3.5%

-

Transactions where merchant country is different from card issuing country (cross-border fee)

-

Up to 1.8%

-

ATM:

-

• Withdrawals (cash advance)

-

3.15 USD / 2.50 EUR/ 1.95 GBP

-

• Balance inquiry

-

1.00 USD / 0.87 EUR / 0.65 GBP

-

Other fees:

-

• Card delivery with express shipping (DHL)

-

40.00 USD

-

• Card replacement

-

12.95 USD / 9.95 EUR / 9.95 GBP

PAY

Paying suppliers and contractors is simple when you partner with Payoneer. Whether you’re a Payoneer customer, or just want to pay one, we’ve got you covered.

-

Directly from your Payoneer balance

When you earn funds from clients and marketplaces, those funds will land in your Payoneer balance. From there you can pay suppliers and contractors directly with the following fees:

-

If recipient has a Payoneer account:

You can send other Payoneer customers funds directly from your balance to theirs for free!

-

FREE

TO A RECIPIENT’S PAYONEER ACCOUNT

-

If recipient doesn’t have a Payoneer account

If the person you are paying is not a Payoneer customer, no problem at all. You can pay them directly from your Payoneer balance to their bank account via bank transfer.

-

A lower fee is available for higher-earning customers.

-

Note: Additional fees may be charged by the recipient’s bank. Bank processing fees, landing fees, or intermediary fees may be deducted by their bank or any other payment provider not directly associated with Payoneer.

-

FREE

TO A RECIPIENT’S PAYONEER ACCOUNT

-

UP TO 2% OF TRANSACTION AMOUNT

Minimum fee may apply

-

For transactions involving currency exchange, the exchange rate of the transaction is based on wholesale currency market rates obtained at the time of transaction from a range of financial institutions and includes the conversion fee where indicated.

-

A fixed fee will apply when you use your USD, EUR, or GBP balance to make a payment to someone whose bank account:

• is in the same currency as your balance

-

• is in a country where the payment currency is the local currency

-

• is in the same country that you have listed in your Payoneer profile

-

Payoneer customers can also make batch payments to up to 200 bank accounts at once with a 2% fee.

-

1.50 USD

USD to USD payment

-

1.50 EUR

EUR to EUR payment

-

1.50 GBP

GBP to GBP payment

-

UP TO 2% OF TRANSACTION AMOUNT

Minimum fee may apply

-

For transactions involving currency exchange, the exchange rate of the transaction is based on wholesale currency market rates obtained at the time of transaction from a range of financial institutions and includes the conversion fee where indicated.

-

Not receiving earnings with Payoneer? No problem! You can also:

-

Pay a Payoneer customer for their business services

Millions of suppliers, freelancers, and other contractors get paid with Payoneer. You can pay any of them via credit card, ACH bank debit (US only), or local bank transfer and enjoy competitively low rates.

-

Note: Payment method may vary by country (for details see our FAQ). Fees shown are maximums and may be lower depending on the recipient. When making a payment, you can choose to either pay the fee or pass it on to the recipient.

-

1%

ACH bank debit

-

3%

Credit Card

-

1%

Local bank transfer

OTHER FEES

-

Manage currencies with ease

You’ll always have the currency you need for your international payments with the ability to move funds between your Payoneer balances. You’ll pay a 0.5% fee based on the entered amount to transfer.

-

Fees are automatically calculated so you always know how much money you’ll receive. Learn More

-

0.5%

OF AMOUNT TO TRANSFER

-

Annual account fee

If your account is active, you’ll never pay this fee.

-

If you keep your account open for 12 months without making a transaction in your Payoneer account or on your Payoneer card, you’ll be charged a 29.95 USD fee.

-

29.95 USD

ANNUAL ACCOUNT FEE

-

Escheatment fee

If we are required to escheat your funds to the applicable State, we will deduct a processing fee in the amount permitted by the State.

-

VARIABLE PER STATE

Don't Miss an Update

Subscribe below, and be first to hear when we have new resources, tutorials, classes & more!