Starting a successful business requires a lot more than money and dedication. On the contrary, there is an endless list of subtleties to consider before you even lay the foundations throughout every single day of operation.

In the following article, we will discuss several of the most important things to consider when starting a business – invoicing tools, payment processors, payroll management, and accounting software. All these tools and systems are connected to the financial aspect of your business and they are even not all that you should consider.

Simply said, no business will operate successfully without any of these tools. It is possible but it will not be effective in the current modern state of the business world. With this said, let us take a closer look at each one.

The financial aspect is the most important part of every business owner. Many years have passed since the days when everything was manual and slow. Today, businesses utilize simple, yet effective accounting software that deals with all the aspects of the financial processes.

If you have not yet introduced accounting software to your business, here is why you should reconsider.

One if the key benefits of using accounting software are the speed at which transactions are being held and completed. Employees no longer need to manually deal with all the small aspects since transactions will be automatic for the most part.

Human errors have always been part of the process. No matter how good you are at your job, problems happen. With accounting software, all the calculations will be done automatically with little to no need of your help.

Here is another reason how accounting software relieves employees from work and improves their effectiveness – through accurate reporting. Since everything will now be stored in the software, you can rest assured that the monthly reports will feature all financial data without any mistakes that could occur with manual work.

Business owners could easily get confused with the abundance of similar tools and software. In most cases, people wonder why they would need invoicing software when they already paid for accounting. Invoicing is a part of accounting but it goes into the bigger depth that is required for the absolute functionality.

Here is why you need both.

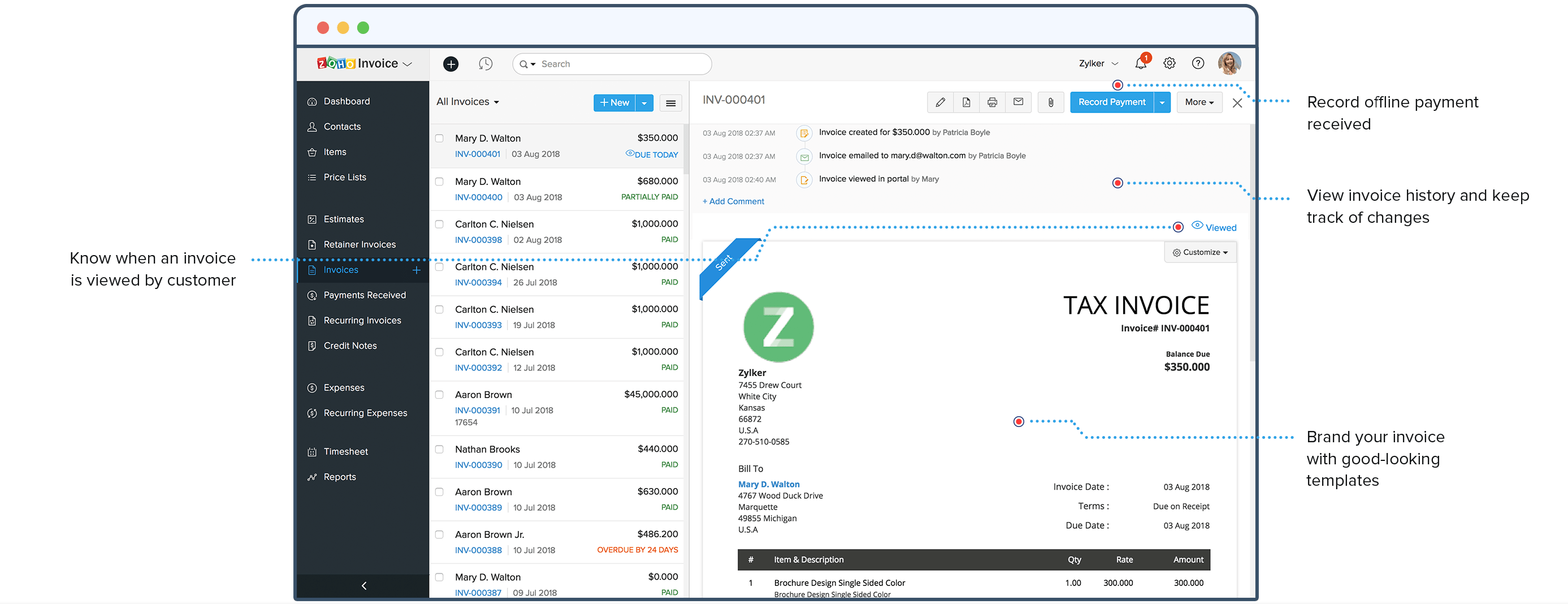

Invoicing tools are used to create invoices in the quickest and simplest way possible. You will have templates or you will be able to create your own templates that you can later use to instantly fill the necessary information. Plus, you can always customize every single invoice, if necessary.

Invoicing tools allow you to incorporate different payment methods and make the whole process automatic. It allows your payers to choose the way to receive their invoices as some still prefer physical deliveries.

Last but not least, invoice tools allow you to integrate the payment process on various devices including phones. Moreover, it provides significantly faster processing than any other alternative.

As you can guess from the name itself, a payroll management system deals with all the aspects involved with salaries and all other types of payments and bonuses directed to your employees. Simply said, one large system will combine all the small manual processes into one large automatic process and save you time, effort, and a lot of money.

Assuming you want to do business right, you should already have an HR department that deals with everything related to your employees. In today’s world, you should take care of your employees and consider them as the most important asset.

With a payroll management system, your HR department will move to the next level in terms of efficiency.

A payroll management system will make all the tasks of your HR department simpler. This is because the system will keep the information of every employee and there will be no need to type it down over and over every month.

It will also keep track and do all the calculations connected to payments, salaries, and taxes. As a result, this will decrease the chance of errors in calculations that cause a number of major problems.

Payroll management systems present the possibility to keep track of the work completed by every single employee. A business owner should trust and believe their employees but it is always beneficial to have systems that follow their progress and working experience.

These possibilities allow you to know which employees are progressing and which are prone to failure. Productivity is what drives the business forward and such systems allow you to make changes before it is too late.

Last but not least, you need payment processors if you want the transactions to succeed. If you are unfamiliar with the term, this is the company that handles the payments from the moment the customer tries to pay with his/her credit card.

Whatever issues there may be throughout the process, the payment processor has the task to complete it and deal with the issues. From the security checks to the acceptance of the payment method, through the transfer of the funds from the customers’ bank to your businesses’ bank – they do it all.

New business owners are often more excited than knowledgeable which leads to obvious issues when the business work begins. We discussed four tools and systems that you need to consider for your business if you want to optimize the processes connected to the financial side of your business.

These beneficial tools will improve the performance and productivity of your employees while decreasing the chance of human errors. Automation and optimization do not mean that businesses will have less need for trained employees in the future. On the contrary, it promises that the employees will be more effective and productive since the majority of time-consuming and boring tasks will be taken off their shoulders.

Have a great software, service, or other resource that would help our users? Submit it to us, and we'll add it to our collection!

Copyright 2022 © Bizzy Guides, All Rights Reserved.